KUALA LUMPUR, June 28 — A six-month moratorium will be given to all individual borrowers whether they are from the B40, M40 or T20 groups, or micro-entrepreneurs, Tan Sri Muhyiddin Yassin said.

The Prime Minister said no more conditions such as income reduction, checks on whether the applicant had lost his job and documentation needed to be submitted for the application.

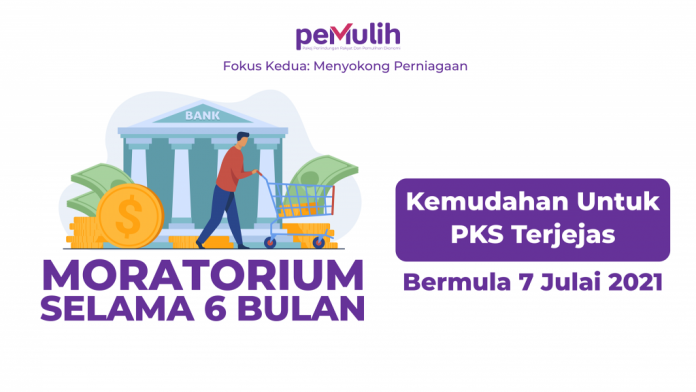

“You just need to apply and approval will be given automatically. This facility is also offered to small and medium enterprise (SME) operators affected subject to checks and approval by the banks.

“Applications will open on July 7, 2021. Borrowers only need to apply and sign an agreement to amend the relevant loan conditions,” he said when announcing the People’s Well-Being and Economic Recovery Package (PEMULIH) which was broadcast live today.

Muhyiddin said the government understood the grievances of the people, as many were affected and not just those from the B40 group.

He said the M40 and T20 groups also endured an increase in dependents as they also helped family members or relatives affected by COVID-19.

“I hope this moratorium initiative can to some extent help individual borrowers and SMEs in managing their cash flow during this challenging period.

“However, let me advise you to make the best use of this offer and if it is not urgent, do not make additional financial commitments,” he said.

Under PEMERKASA Plus unveiled recently, the government, in collaboration with Bank Negara Malaysia (BNM) and the banks, has implemented a targeted loan repayment initiative.

So far, more than 250,000 eligible borrowers have obtained approval automatically, choosing either to seek a moratorium for three months or a 50 per cent reduction in instalment payments for six months.

Meanwhile, the Prime Minister said BNM is also committed to providing access to financial assistance to SMEs.

So far, there is still an existing balance of RM6.6 billion out of the total RM25.1 billion provided by the central bank for the benefit of new applicants.

“Under the PEMULIH package, BNM has agreed to add an additional RM2 billion to bring the remaining fund amount to RM8.6 billion.

“It is hoped that this fund will be able to meet the various needs of SMEs and micro-entrepreneurs in easing the cash-flow constraints of their businesses,” he added.