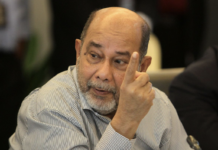

KUALA LUMPUR (NST) : Country Heights Holdings Bhd founder Tan Sri Lee Kim Yew believes that there are “rough forces” in the market attempting to bring his company down by disposing shares through nominees, according to sources close to him.

They said Country Heights was unfazed about the sharp selling of its shares by “some parties” and would instead focus on building all of the businesses announced to show profits in the book.

“Lee is taking it easy and will not retaliate. He simply wishes to use his life philosophy, the rule of law, and his integrity to overcome all of the obstacles placed before him. He aspires to be a good role model for his children and future generations,” according to a source.

Bursa Malaysia slapped Country Heights with an unusual market activity (UMA) query on May 18 after trading volume in its shares increased dramatically and its share price hit a limit down.

The stock opened one sen higher at RM1.20 at the opening bell but then fell to the limit down at 83.5 sen, a drop of 35.5 sen or 29.83 per cent.

At 83.5 sen, Country Heights is worth RM247.99 million.

Bursa requested that Country Heights disclose any corporate developments, rumours, or reports concerning the group’s business and affairs and any other possible reasons for the UMA.

In response to the stock exchange, Country Heights said the board was not aware of any corporate developments relating to the group’s business and affairs that had not previously been announced that could account for the trading activity, including those in the negotiation/discussion stage.

“Looking at the short selling, it is quite likely that someone out there knowing he has a share margin, is selling down the shares with a margin call to bring down the group’s value.

“Lee will defend his shareholding and inform the public that he recognises his share value is greater than the market value. He has been utilising the group’s resources to create value for Country Heights and demonstrate profits,” the source said.

Since April 1, 2021, Lee has gradually increased his stake in Country Heights.

He owned 78.24 million shares, or 26.54 per cent as of May 26, while his indirect shareholding was 106.18 million or 36.01 per cent.

“In any corporate exercise, existing shareholders will recognise the group’s value. The NTA (net tangible asset) of Country Heights is RM3.00. Lee, as a major shareholder, is also considering the RNAV (realisable net asset value). The figures speak for themselves.

“Last but not least, people must remember that he has his Lee family generation and private assets with a very bright future,” the source said.

When Country Heights announced that it had signed five heads of agreement to acquire assets worth RM554 million from Lee’s investment holdings on October 6 last year, the stock jumped 25 per cent from its closing price of RM1.20.

Country Heights stated in its October 6 announcement that the assets acquired from Lee’s holdings would be satisfied by the issuance of new shares at RM1.20 per share.

On December 28, the group reached a multi-year high of RM2.14 before closing at RM1.98 after announcing that it had entered into a licencing and collaboration agreement with Beijing Wodong Tianjun Information Technology Co Ltd, a wholly-owned subsidiary of JD.com, China’s leading technology-driven eCommerce company.

The collaboration will result in the development of JD.com’s omnichannel business model for the Malaysian market, utilising its technologies and Country Heights’ resources.