KUALA LUMPUR, June 13 – Malaysia’s tax system requires reform due to its imbalanced distribution of non-tax revenue, which tends to narrow the tax base, said an economist.

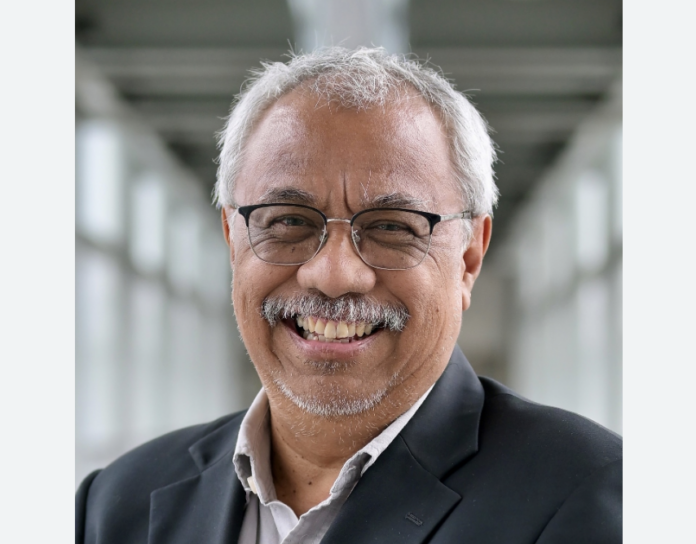

Dr Nungsari Ahmad Radhi, who is a member of Bank Negara Malaysia’s (BNM) board of directors, said that the country’s taxation system must undergo reform to give greater buoyancy to government revenue and to broaden the tax base.

“The problem with our tax base is that it is not buoyant to show a one per cent gross domestic product growth yields more than one per cent tax revenue,” he said at the BNM-organised Sasana Symposium 2024.

Nungsari was one of the panellists in a session themed “Navigating Economic Cycles: Interactions Between Monetary and Fiscal Policies”.

He emphasised that the current taxation system relies on direct taxes, such as income and corporate taxes, and taxpayers will be monitoring government spending.

Nungsari said the dependency on non-tax revenue in the form of dividends from Petroliam Nasional Bhd (Petronas) is not sustainable in a long run.

“We have been taking so much from Petronas, they are not making enough investments to explore more wells to pay the dividends they have been paying.

“We have to be prepared for the post-carbon, post-(crude) oil scenario where petroleum-based revenues will no longer be there as in the past,” he said.

Nungsari, who was appointed as a member of the Policy Advisory Committee to the Prime Minister in April this year, said that longer term, structural issues highlighted in Madani Economic framework would need close attention.

The Policy Advisory Committee to the Prime Minister provides counsel on matters concerning national development and economic resilience in line with the Madani Economy.

Sasana Symposium 2024 spans over two days from June 12-13, 2024, with the theme “Structural Reforms: Making it a Reality for Malaysia”.